Nifty settles above 20k level

Sensex rises for 9th straight session as banking, energy and metal shares gain

image for illustrative purpose

Mumbai: Benchmark Sensex rose for a ninth straight session, while NSE Nifty closed above the record 20,000 mark for the first time on Wednesday as positive macroeconomic data triggered buying in banking, energy and telecom shares.

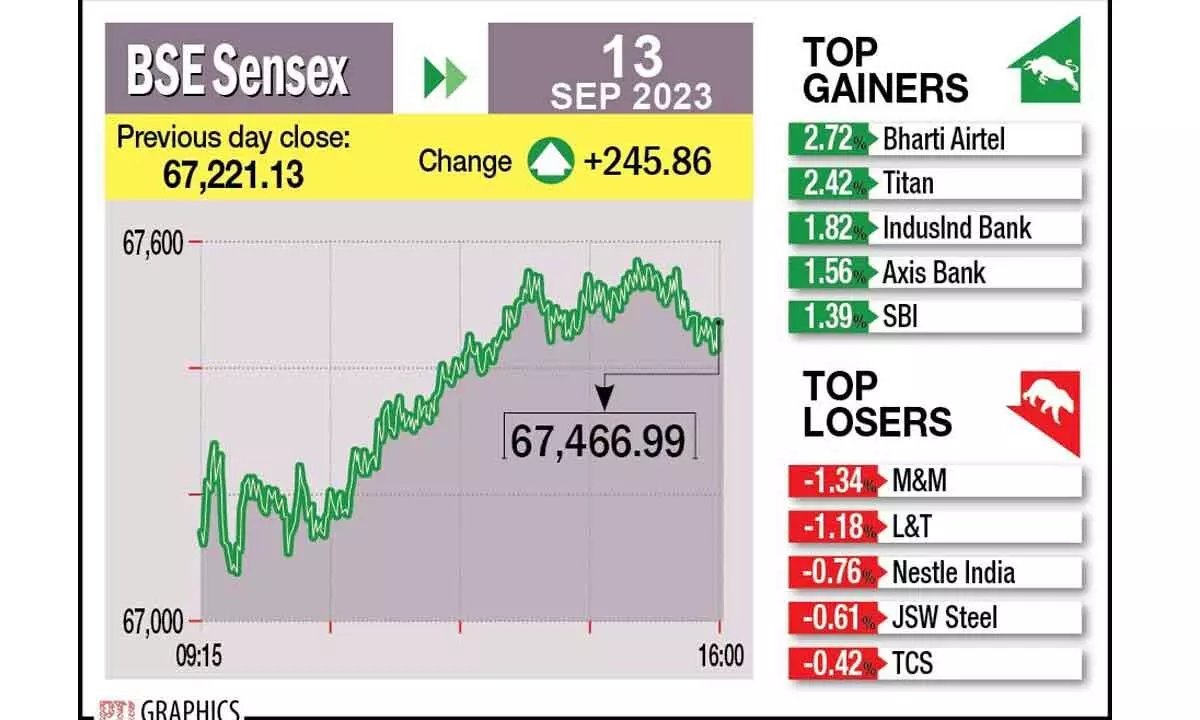

The 30-share BSE Sensex bounced back from early lows to trade near its all-time high levels at 67,565.41 in day trading. Sensex hit the all-time intra-day high of 67,619.17 on July 20, 2023. The barometer finally settled at 67,466.99, up 245.86 points or 0.37 per cent, extending its gains to a ninth straight session - the longest winning streak in last five months.

As many as 20 Sensex shares closed in the green while 10 declined. The broader Nifty closed above the 20,000 mark for the first time, rallying 76.80 points or 0.38 per cent to 20,070, its all-time closing high. Of 50 Nifty shares, 31 closed higher and 19 declined. Among the Sensex firms, Bharti Airtel rose the most by 2.72 per cent.

Titan, IndusInd Bank, Axis Bank, State Bank of India, Power Grid, NTPC and Tata Motors were among the among the major gainers. Mahindra & Mahindra, Larsen & Toubro, Nestle, JSW Steel, Infosys and Tata Consultancy Services, Tech Mahindra and Maruti were the major laggards.

“The domestic indices resumed an upward trajectory despite weak global cues. The cooling of domestic CPI inflation to 6.83 per cent in August and the rise in industrial production data reaffirmed the robustness of the Indian economy,” said Vinod Nair, head (research) at Geojit Financial Services.

Foreign Institutional Investors (FIIs) offloaded equities worth Rs1,047.19 crore after a day’s breather, according to exchange data.

. In the broader market, the BSE smallcap gauge climbed 0.85 per cent and midcap index gained 0.19 per cent. Among the indices, telecommunication consumer durables climbed 1.24 per cent, energy gained 1.19 per cent, oil & gas (1.13 per cent), metal (1.04 per cent), commodities (0.96 per cent) and bankex (0.89 per cent). Industrials, IT, auto, capital goods and services were the laggards. The contraction in the UK economy and a rise in oil prices have created a level of uncertainty in the global market. Also, investors await US inflation data, which holds global significance as it will provide insights into the Fed’s policy outlook, Nair added. Retail inflation declined to 6.83 per cent in August after touching a 15-month high of 7.44 per cent in July, mainly due to softening prices of vegetables, but still remains above the Reserve Bank’s comfort zone.